do nonprofits pay taxes in canada

For nonprofit organizations tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. There are certain circumstances however they may need to make payments.

What Is A Not For Profit Organization Types Examples More

Sales of food meals beverages and similar items under a number of different circumstances.

. Lets Talk Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Canada has a 5 percent federal tax known as the Goods and Services Tax GST however the GST does not apply to foreign grants. A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. Under the Act a charity can apply to the Canada Revenue Agency for registration. CRA can assess penalties of 25 per day for failure to file this form.

Do non profits pay taxes in Canada. There is no requirement provincially federally or within tax law that non-profit organizations have a particular legal form meaning they may be corporations trusts or unincorporated associations. Generally a non-profit organization is a qualifying non-profit organization for a fiscal year if its percentage of government funding for the fiscal year or for the previous two fiscal years is.

Taxes Nonprofits DONT Pay Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. That said youll want to check your local rules in case they differ from federal ones. For the most part nonprofits are exempt from most individual and corporate taxes.

There are differences between these types of organizations. The Non-Profit Information Return form T1044 due no later than six months after the end of your fiscal year is often overlooked by NPOs. If only a portion of a property owned by a non-profit satisfies the use requirements that portion can be exempt and the rest of the property can be taxable.

The minimum penalty is 100 up to a maximum of 2500 for each failure to file. Religious organizations are generally registered charities in Canada. Not-for-profit corporations therefore are not necessarily exempt from paying regular corporate taxes under the.

The CRA bans both of these organizations from using their income to benefit members. Nonprofits are also exempt from paying sales tax and property tax. Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency.

Now lets apply these general principles to a few specific situations involving non-profits. While the income of a nonprofit organization may not be subject to. There are few supplies that are HSTGST-exempt for nonprofits.

Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors. What taxes do nonprofits pay. As such they are non-profit by nature and as such do not pay income tax as they earn no profit.

Which Taxes Might a Nonprofit Pay. With regard to customs duties there are no particular exemptions for charities or NPOs. Furthermore they issue receipts for donations which gain tax credits for donors.

Non-profits that are not registered charities may have to file a T2 corporate return if they are incorporated andor an information form T1044. Both charities and nonprofit organizations do not have to pay income tax. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

Income tax Not-for-profit corporations are not automatically considered registered charities or non-profit organizations for income tax purposes. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors.

Only certain NPOs have to file form T1044. Non-profit organizations whose primary purpose and operation is related to the promotion of amateur athletics in Canada is exempted from this rule. In accordance with the type of nonprofit organization the value of its assets and other factors nonprofit organizations must file.

Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act. Most are also exempt from state and local property and sales taxes. There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status.

Additionally nonprofits and churches are exempt from paying all property taxes. A Charitable Non-Profit Organization Owns the Property. Generally non-profits are exempt from paying income tax except for a few rules around property income or capital gains.

Moreover while charities and NPOs are subject to the GST regime there are many potentially applicable exemptions. Once accepted a registered charity is exempt from income tax under paragraph 149 1 f. As for real estate houses of worship are exempt from municipal property tax.

You do not have to be registered for the GSTHST to claim this rebate. Although nonprofit organizations in Canada do not have to pay income taxes they do have to submit their tax returns with the Canada Revenue Agency. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

Are nonprofit organizations tax exempt in Canada. Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist for late filing. Both charities and nonprofit organizations do not have to pay income tax.

Distinguishing a non-profit organization from a charity An NPO cannot be a charity as defined in the Income Tax Act. The CRA bans both of these organizations from using their income to benefit members. Nonprofits are also exempt from paying sales tax and property tax.

All nonprofits are exempt from federal corporate income taxes. Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission.

Don Nonprofit Organization In Canada Have A Tax Id Ictsd Org

Ask A Tax Attorney Get The Best Tax Legal Aid Near You Are You Facing The Issues Of Inland Revenue Service Irs And Need Qu Tax Attorney Tax Lawyer Tax Debt

Maine Budget Proposal Includes Controversial Tax Changes For Large Nonprofits Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Fun Fundraisers Nonprofit Fundraising Non Profit

Intuit Quickbooks Desktop Premier 2021 Pc Download In 2021 Quickbooks Business Accounting Software Small Business Accounting

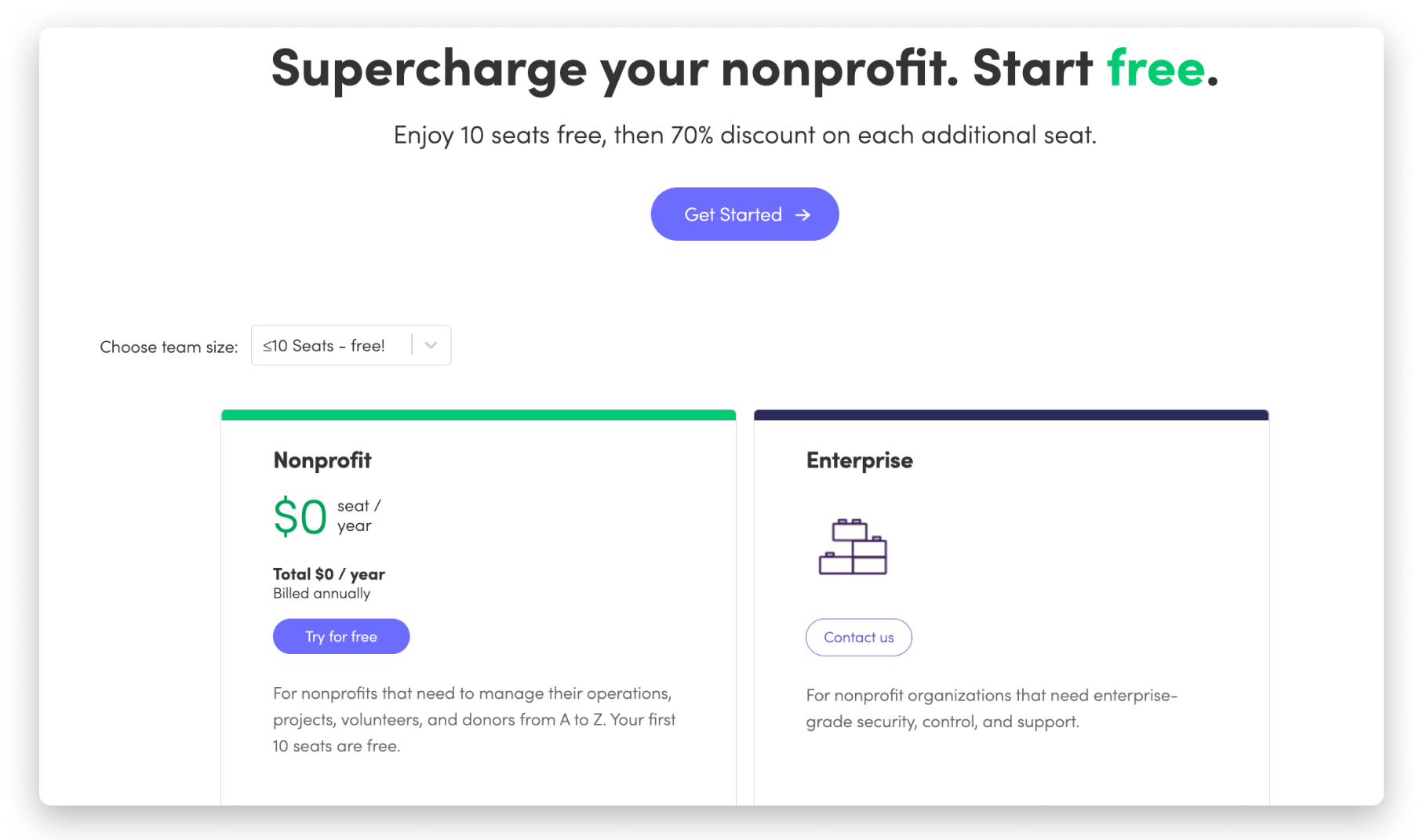

Monday Com Discount For Nonprofits Support

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)